Professional Indemnity Insurance For Medical Professionals

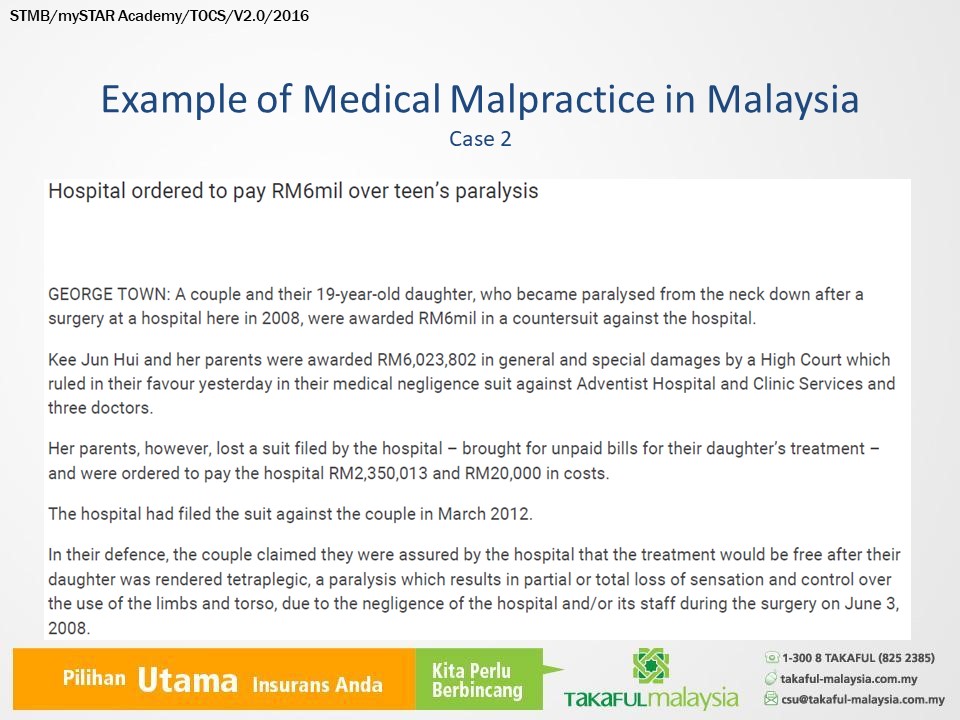

We know that medical or healthcare professionals and establishments are very vulnerable to complex risks and costly litigation. A form of professional indemnity insurance, medical malpractice insurance provides individual healthcare practitioners and medical establishments with protection and tools to manage the evolving risks of today’s complex healthcare industry.

This is to calculate estimated contribution by using this calculator.

Fill in the Application Form here. You will get an official Quotation Slip to your email within 1-3 working days.

After you have received and agree with the Quotation Slip, you are required to reply our email with the instruction to proceed.

You may proceed with the payment within 14 working days after the confirmation date.

Certificate in pdf format will be issued within 14 working days.

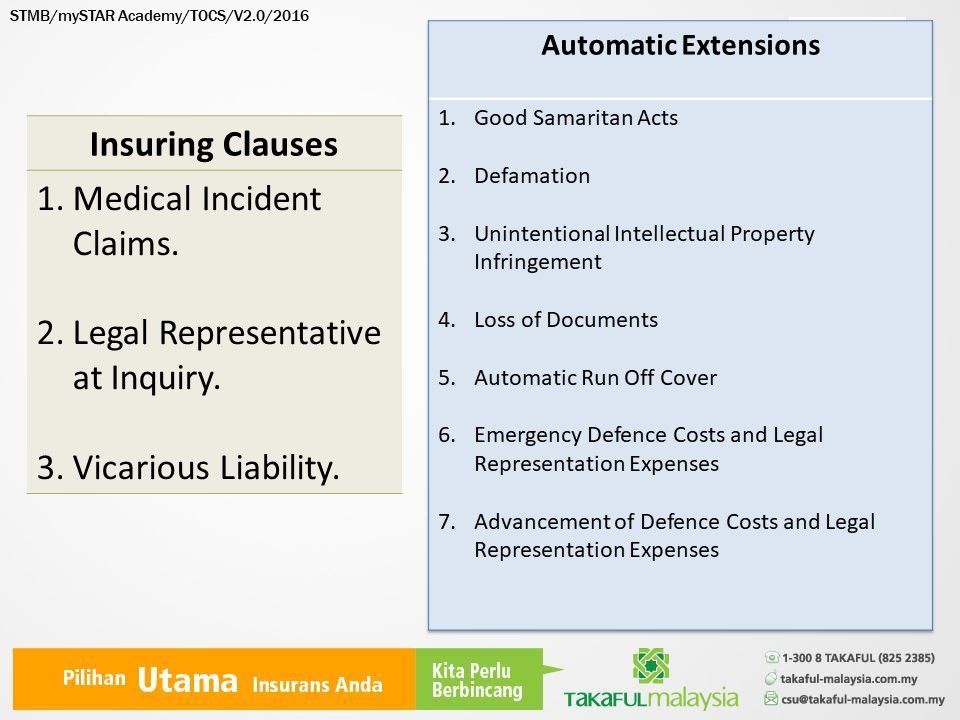

Coverage that you will get

-

Full Retrospective Cover for Participant who currently has similar and uninterrupted cover

-

Unlimited Run Off Cover with structured additional contribution

-

Medical Incident cover for loss resulting from a medical incident by the Participant in the provision of healthcare services

-

Legal representation at inquiry cover (up to certain sub-limit) incurred directly or in connection with Partidpant co-operating with an inquiry

-

Vicarious liability cover arising from any act, error or omission of any locum doctor covering the duties of the Participant in the provision of professional healthcare services for which the Participant is legally liable

-

Good Samaritan Acts cover for any loss resulting from a Claim or Inquiry arising from the provision of emergency first aid services

-

Defamation cover for any loss resulting from a claim for unintentional defamation by the Participant in the provision of Professional Healthcare Services

-

Intellectual Property Infringement cover for any loss resulting from a claim for unintentional infringement of any intellectual property right (other than patent right) by the Participant in the provision of Professional Healthcare Services

-

Loss of Documents cover for any loss resulting from a claim for the loss of, damage to or destruction of documents for which the Participant Is legally responsible in the provision of Professional Healthcare

-

Emergency Defence Costs and Legal Representation Expenses cover, in the event it is not possible for the Participant to obtain underwriter’s written consent prior to the incurring of defence costs or legal representation expenses

-

Advancement of Defence Costs and Legal Representation Expenses cover within 30 days of receipt and approval of an invoice for such defence costs or legal representation expenses

-

Cyber and Privacy Infringement cover for any loss resulting from a claim or an Inquiry for any unintentional Cyber and Privacy Infringement by the Participant in the provision of professional healthcare services

Frequently Asked Question

How much is the contribution for this Takaful?

The contribution for this Takaful may varies individually depending on specialities, limit of liability, claim experience, and other underwriting considerations.

How do I make payment?

Payment made to Syarikat Takaful Malaysia Am Berhad via Online Transfer, or via Credit Card using payment gateway.

When can I apply for APC next year?For APC application, you may : – Updated on 1 July Apply now. Coverage starts on 1/1/2021 until 31/12/2021

Period of coverage?

Full 1 year coverage, or Minimum 6 month coverage, with period end by 31st December each year.Any coverage less than ONE year, will be prorated and extend to next year.

Is my case automatically accepted after I submit my application?

If there is no claim or alleged claim against you before application, we will confirm acceptance to you within 3 working days of receipt via email stating the effective date of cover. Please call us if you fail to hear from us within a week of your application.

When will my Takaful cover commence?

When we receive your application, we will respond to you within 2 working days as follows:

We will acknowlege the receipt of the application documents. If your takaful application is acceptable, we will confirm cover on the same day. The certificate will be issued after your payment has been cleared.

Please contact us if you fail to hear from us within a week of your email or postage.

In the event of a claim against me, what do I do?

In the event of a claim or if you are aware of a potential claim, please notify claim manager of Syarikat Takaful Malaysia Am Berhad.

If there is a claim or alleged claim against me before application, will my application be accepted?

This will be treated separately. We will need the claim and/or alleged claim details and may propose an offer with certain terms and conditions.

How much am I covered for?

You may choose one from below:

Option 1 : RM250,000 any one claim and in the aggregate

Option 2 : RM500,000 any one claim and in the aggregate

Option 3 : RM1,000,000 any one claim and in the aggregate

Option 4 : RM1,500,000 any one claim and in the aggregate

Option 5 : RM2,000,000 any one claim and in the aggregate

Option 6 : RM3,000,000 any one claim and in the aggregate

Option 7 : RM5,000,000 any one claim and in the aggregate Limit of liability differs according to nature of services.

Does having my own individual medical practitioners indemnity make me a more likely target for a lawsuit?

No, having your own takaful coverage does not make you a more likely target for a lawsuit. When something happens and a patient is injured, most lawyers will name everyone who was involved in the patients’ care in the lawsuit—whether you have your own coverage or not.